Table of Content

If you are planning to opt for a ICICI Home Loan Balance Transfer for another bank or financial institute to ICICI Bank, here are the list of documents required for doing a balance transfer for both – salaried applicants and self-employed applicants. ICICI Bank typically takes 3-7 working days to sanction the loan post verification and processing. You can keep a track of your home loan by checking your home loan application status.

You can also switch from a fixed rate to a floating rate by paying a nominal switching fee of 1.75% of the outstanding loan. Co-applicant's income can be considered for enhancing your loan eligibility or increasing your loan amount. Please ensure that all financial documents of co-applicant are attached with your India Home Loan Application.

Federal BankHome Loan

Got a property that you can mortgage in exchange for a loan? Then you can avail ICICI Bank’s Loan Against Property for your business or personal needs. Mortgage both residential and commercial properties and enjoy comfortable EMIs over long tenures going up to 15 years.

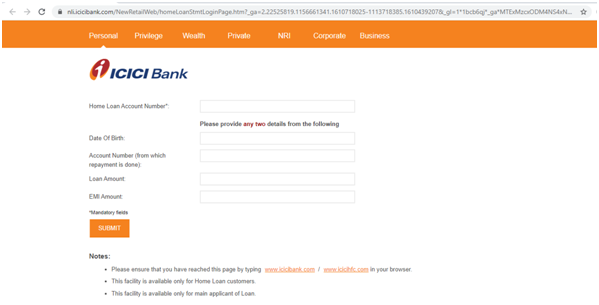

You can check your loan application status through various online channels like the official website of ICICI Bank, through the ICICI TrackMyLoan service, and the ICICI iMobile smartphone app. For more information, refer to the ‘How to check ICICI home loan application status online? Mortgage customer service solutions are now available, at your fingertips!

How can I partly prepay or foreclose the loan?

PAN Application Date and PAN Acknowledgment Number on Form 60 is mandatory if the customer’s taxable income in India is Rs 250,000 or more. By continuing to use the site, you are accepting the bank'sprivacy policy. The information collected would be used to improve your web journey & to personalize your website experience.

I/We understand that sanction of loan is at the sole discretion of ICICI Bank. ICICI Bank reserves the right to reject the application without assigning any reason and shall not held liable for such rejection. With respect to pre-approved loan, if any, ICICI Bank reserves the right at any time to withdraw the loan offer and/ or modify, alter the pre- approved loan, terms and conditions and / or ask for any additional document /information from customer. The loan facility will only be established/disbursed upon completion of definitive loan documents and other terms and conditions as ICICI Bank may reasonably require. You can connect with customer care using customer care numbers, by filling up web query form or through iMobile app.

Can I avail of Top-up Loan in addition to balance transfer from ICICI Bank?

This is because the outstanding loan amount is higher in the initial years of the home loan. The EMI paid by them in the initial years has a higher share of interest paid than the outstanding loan amount. You can check the full list of documents required for ICICI home loans here. I declare that the Information I have provided above is accurate and complete to the best of my knowledge.I authorize ICICI Bank & its representatives to call or sms me with reference to my loan application.

ICICI Bank is a leading public sector bank of India that significantly caters to diversified home financing needs of the country of 130 crore people. Whether you need a loan for your first home or for upgrading to a dream home, ICICI Bank extends hassle-free home loan solutions for people of varied income group. Yes, it is possible to get higher loan eligibility for your home loan by adding a co-applicant.

An applicant can get a maximum loan amount of Rs.1 Crore for a tenure of up to 30 years. The ICICI Instant Home Loan offered to the existing customers and employees of ICICI Bank. However, those home loan borrowers who have had home loans going for more than 5 years or so, will have less impact as their EMIs will have a higher share of outstanding loan amount than the interest paid amount.

Yes, MCLR can be different between different banks as it will depend on marginal cost of funds, negative carry on account of Cash Reserve Ratio , operating costs, tenor premium of respective banks. In case of floating rate loans, the Banks can specify dates of interest reset which will be linked to either the date of first disbursement or date of review of MCLR. You are eligible for tax benefits on the principal and interest components of your balance transfer loan under the Income Tax Act, 1961. We also need your official email ID to write to you in case we can't get in touch with you through other means.

I also authorize ICICI Bank and its representatives to call/e-Mail/SMS/WhatsApp me regarding Home loan application. To protect the consumers' interests, the RBI appoints independent banking ombudsman who looks after consumer queries that are not resolved even after 1 month of raising the query. You can share your issue with independent BO official, and expect action against the bank for not addressing your complaint appropriately. However, make sure you contact the BO only after reaching out the senior officials and going through each level of complaint redressal discussed above. In this age of the internet, a social media shout-out is as good as calling the bank's customer care number. In many cases, you can expect a faster resolution for your query via a social media channel.

The rate is reset with reference to the ICICI Home Loan Prime Lending Rate prevailing on the dates of the respective resets. When the rates are reset, customers have the option of either adjusting their loan installment or the loan tenure, subject to the overall restrictions on the loan tenure. Repayment is done in equated monthly instalments , and includes interest and principal amount calculated on monthly rests. You can pay EMIs by issuing post-dated cheques from yourNRE/NROaccount, or any other account approved by the Reserve Bank of India . In the case of part-disbursement of the loan, the monthly interest is payable only on the disbursed amount. In addition to such details, one has to furnish the PAN of the lender as well.

You prepay EMIs on ICICI home loan online using net banking. However to foreclose the account, it is advisable to visit the bank with cheque and obtain the ‘no objection certificate’ for the loan. With trust of 70 lakh customers, we assure hassle free access to the best Home Loans up to 10 crore for housing loan borrowers in India. We use latest technology and AI to serve customers across the length & breadth of our diverse country. Here you can raise your complaint for the first time and also check the status of the query later on.

However, do note that for existing home loan borrowers, the impact will depend on the outstanding home loan amount. Home Loan will be disbursed as soon as you select property, submit the required property, income and KYC documents, the property is legally and technically sound and you provide own contribution receipt. Disbursement will be made in Indian currency in favour of seller/builder as the case may be in ICICI Bank branch where you applied for Home Loan. Depending on the movement of interest rates in the market, the interest rate for the loan is reset at the beginning of every quarter, i.e.

No comments:

Post a Comment